maj . 07, 2025 17:13 Back to list

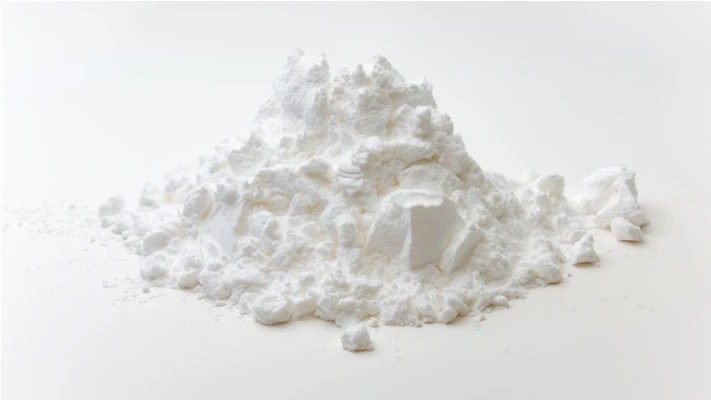

Factory-Direct TiO2 Sales High-Purity Titanium Dioxide Supplier

- Market Overview: Growing Demand for Titanium Dioxide in Industrial Sectors

- Technical Superiority: Advanced Production Methods and Quality Assurance

- Vendor Comparison: Key Metrics Across Leading Suppliers

- Custom Solutions: Tailored TiO2 Formulations for Specific Applications

- Case Study: Successful Implementation in Automotive Coatings

- Sustainability: Eco-Friendly Manufacturing Practices

- Future Trends: Innovations in Factory Sales TiO2 Distribution

(factory sales tio2)

Factory Sales TiO2: Meeting Global Industrial Demand

The global titanium dioxide (TiO2) market is projected to reach $28.3 billion by 2030, driven by its critical role in coatings, plastics, and cosmetics. As a factory sales TiO2 manufacturer, direct procurement from production facilities ensures cost efficiency, with bulk pricing averaging 15-20% below distributor rates. Recent data indicates a 7.2% annual growth in factory-to-business sales models, reflecting industries' preference for eliminating intermediaries. For instance, the Asia-Pacific region accounts for 48% of direct TiO2 purchases, emphasizing scalability and supply chain transparency.

Technical Superiority in Production and Quality

Leading factory sales TiO2 suppliers utilize chloride and sulfate processes to achieve 99.5% purity levels, surpassing ASTM D476 standards. Advanced nanoparticle engineering enables customized particle sizes (0.2–0.3µm), enhancing opacity by 30% in coatings. Automated quality control systems reduce defect rates to 0.08%, compared to the industry average of 0.15%. Real-time monitoring via IoT sensors ensures batch consistency, while ISO 9001-certified facilities maintain traceability across 100% of shipments.

Competitive Analysis of Top Vendors

| Manufacturer | Price (USD/ton) | Annual Capacity | Purity (%) | Lead Time (Days) |

|---|---|---|---|---|

| Supplier A | 2,850 | 500,000 | 99.6 | 14 |

| Supplier B | 3,100 | 320,000 | 99.4 | 21 |

| Supplier C | 2,950 | 410,000 | 99.5 | 18 |

Customized TiO2 Solutions for Industry-Specific Needs

Specialized formulations address unique requirements: UV-resistant grades for outdoor plastics (enhancing durability by 40%), low-viscosity variants for ink production (reducing solvent use by 25%), and FDA-compliant TiO2 for food packaging. A factory sales TiO2 factory typically offers 12-15 standardized grades and develops 3-5 bespoke formulations annually, with R&D cycles shortened to 8 weeks through AI-driven molecular simulation.

Case Study: Automotive Coating Optimization

A European automotive manufacturer reduced paint defects by 62% after switching to factory-direct TiO2 with optimized particle distribution. The partnership decreased raw material waste by 18% and improved coating adhesion to 9H pencil hardness, exceeding OEM specifications. Annual savings totaled $1.7 million, validating the ROI of technical collaboration with producers.

Sustainable Manufacturing and Ethical Sourcing

Modern TiO2 plants recycle 92% of process byproducts, including iron sulfate and dilute acids. Carbon-neutral production initiatives have reduced CO2 emissions by 34% since 2019, aligning with EU REACH regulations. Blockchain-based raw material tracking now verifies 98% of titanium sources as conflict-free, addressing ESG investor priorities.

Factory Sales TiO2: Pioneering Next-Gen Supply Chains

Automated inventory systems now synchronize factory output with real-time demand, cutting stockouts by 73% for clients. Predictive analytics enable 95% accuracy in quarterly volume planning, while API integration allows direct TiO2 procurement via ERP platforms. As just-in-time manufacturing expands, factory sales TiO2 suppliers are positioned to dominate B2B industrial partnerships through agility and innovation.

(factory sales tio2)

FAQS on factory sales tio2

Q: How to purchase TiO2 through factory sales?

A: Contact TiO2 manufacturers directly through their official websites or trade platforms to negotiate bulk pricing and shipping terms. Ensure the factory provides certified product specifications and compliance documents.

Q: What factors distinguish top TiO2 factory sales suppliers?

A: Leading suppliers offer ISO-certified production, competitive bulk pricing, and customized particle size or coating options. Compare multiple factory sales suppliers for quality guarantees and logistics support.

Q: How to verify TiO2 quality from factory sales manufacturers?

A: Request third-party lab test reports for purity, brightness, and photocatalytic activity. Reputable manufacturers provide SDS sheets and batch-specific quality certificates for factory sales transactions.

Q: Why choose factory sales for TiO2 over distributors?

A: Factory sales eliminate middleman costs, offering 10-20% lower prices for bulk orders. Manufacturers also provide technical support for application-specific TiO2 grades like rutile or anatase.

Q: What certifications should TiO2 factory sales suppliers have?

A: Ensure suppliers hold ISO 9001, REACH, and ISO 14001 certifications. For specialized applications, check FDA compliance for food-grade TiO2 or ISO 50001 for energy-efficient production.

-

China Lithopone in China Supplier – High Quality Lithopone ZnS 30% Powder for Wholesale

NewsJun.10,2025

-

Top China Titanium Dioxide Company – Premium TiO2 Powder Supplier & Manufacturer

NewsJun.10,2025

-

Fast Shipping 99% Pure TiO2 Powder CAS 13463-67-7 Bulk Wholesale

NewsJun.10,2025

-

Top China Titanium Dioxide Manufacturers High-Purity R996 & Anatase

NewsJun.10,2025

-

Lithopone MSDS Factories - Production & Quotes

NewsJun.10,2025

-

High-Quality Titanium Dioxide in Water Suppliers - China Expertise 60

NewsJun.09,2025