titanium dioxide price in china

Jan . 14, 2025 09:58 Back to list

titanium dioxide price in china

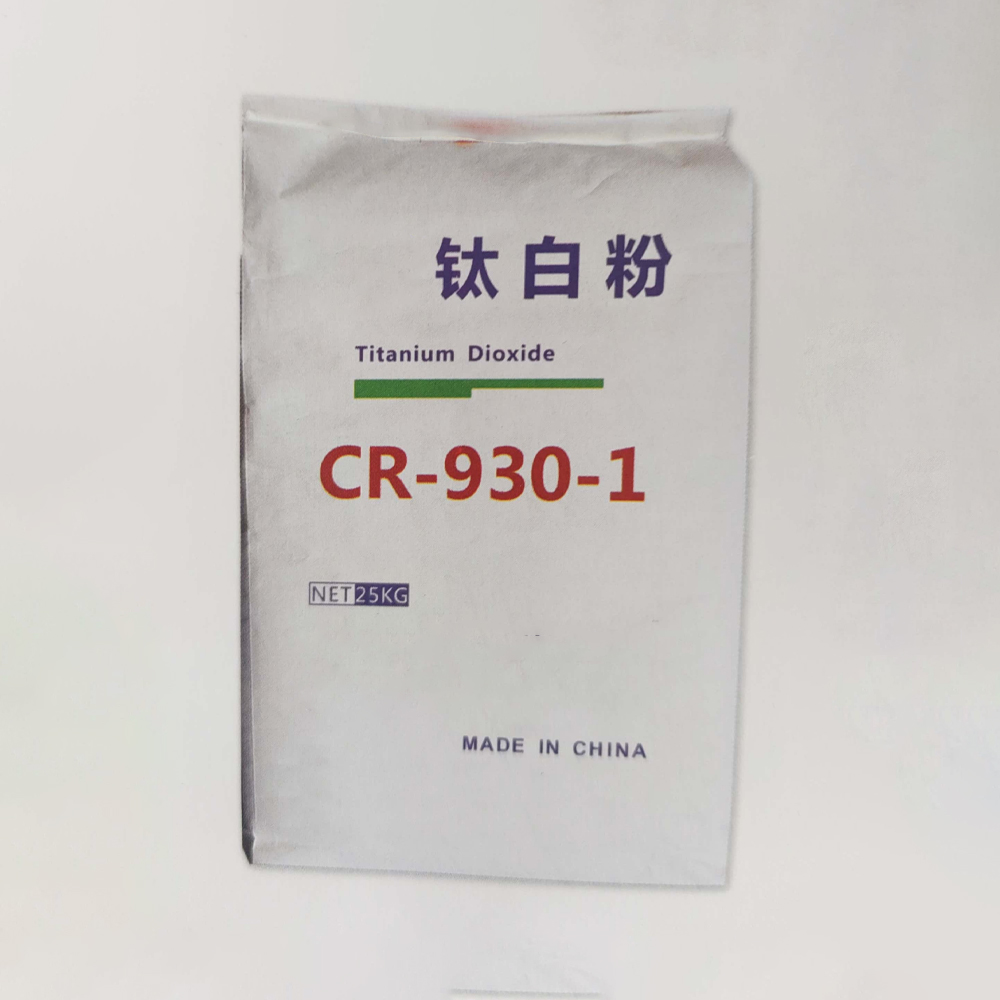

The titanium dioxide market in China presents a complex landscape shaped by a multitude of factors, including domestic production capabilities, international demand, and regulatory influences. As of 2023, the dynamics of this market are increasingly important to understand for manufacturers, investors, and businesses that rely on this essential industrial pigment.

The competitive landscape within China further influences titanium dioxide pricing. The market is bifurcated between large, state-backed enterprises and smaller private companies. State-backed enterprises often benefit from economies of scale and preferential policy treatment, enabling them to stabilize prices compared to smaller competitors who might operate with tighter margins and less governmental support. Moreover, the advent of technological advancements in production processes offers a competitive edge. Companies that invest in research and development to improve the efficiency of their production lines can lower costs and stabilize prices, even when market pressures exist. Firms that successfully implement cutting-edge technology often set the pace in price adjustments, influencing market trends. While price trends have been volatile in recent years, industry experts suggest a cautious optimism for the future. Companies are adopting strategic partnerships and collaborations to strengthen their market positions and mitigate risks associated with raw material supplies and regulatory changes. Furthermore, the focus on sustainability and green manufacturing practices is likely to drive innovation, helping to balance production costs with environmental responsibilities. Understanding the intricacies of the titanium dioxide market in China requires more than just tracking prices; stakeholders need to keep abreast of industry regulations, technological shifts, and global trade dynamics. By doing so, they not only gain insight into current market pricing but also position themselves strategically for future changes in the global market landscape. As the interplay of these factors continues to evolve, those who remain informed and agile will be best equipped to navigate the challenges and opportunities in the titanium dioxide industry. In conclusion, the price of titanium dioxide in China remains a critical indicator of both domestic industrial health and global market conditions. While challenges exist, particularly around regulatory pressures and raw material costs, there are also ample opportunities for those who innovate and adapt to the changing landscape. By focusing on sustainable practices and technological improvements, companies can not only manage costs more effectively but also contribute to shaping a more resilient and environmentally responsible industry.

The competitive landscape within China further influences titanium dioxide pricing. The market is bifurcated between large, state-backed enterprises and smaller private companies. State-backed enterprises often benefit from economies of scale and preferential policy treatment, enabling them to stabilize prices compared to smaller competitors who might operate with tighter margins and less governmental support. Moreover, the advent of technological advancements in production processes offers a competitive edge. Companies that invest in research and development to improve the efficiency of their production lines can lower costs and stabilize prices, even when market pressures exist. Firms that successfully implement cutting-edge technology often set the pace in price adjustments, influencing market trends. While price trends have been volatile in recent years, industry experts suggest a cautious optimism for the future. Companies are adopting strategic partnerships and collaborations to strengthen their market positions and mitigate risks associated with raw material supplies and regulatory changes. Furthermore, the focus on sustainability and green manufacturing practices is likely to drive innovation, helping to balance production costs with environmental responsibilities. Understanding the intricacies of the titanium dioxide market in China requires more than just tracking prices; stakeholders need to keep abreast of industry regulations, technological shifts, and global trade dynamics. By doing so, they not only gain insight into current market pricing but also position themselves strategically for future changes in the global market landscape. As the interplay of these factors continues to evolve, those who remain informed and agile will be best equipped to navigate the challenges and opportunities in the titanium dioxide industry. In conclusion, the price of titanium dioxide in China remains a critical indicator of both domestic industrial health and global market conditions. While challenges exist, particularly around regulatory pressures and raw material costs, there are also ample opportunities for those who innovate and adapt to the changing landscape. By focusing on sustainable practices and technological improvements, companies can not only manage costs more effectively but also contribute to shaping a more resilient and environmentally responsible industry.

Next:

Latest news

-

What is Barium Sulfate Board? Uses, Benefits & Industry Insights

NewsNov.25,2025

-

Essential Guide to Calcium Powder Quotes – Pricing, Quality & Global Insights

NewsNov.24,2025

-

Reliable Anatase TiO2 Pigment Quotes for Sustainable Industry Use | CQ Titanium Dioxide

NewsNov.24,2025

-

Understanding Lithopone B311 Powder Quotes – Market Insights & Applications

NewsNov.23,2025

-

Reliable 30-50nm TiO2 Powders Quotes for Advanced Industrial Use | CQTitanium

NewsNov.23,2025

-

Comprehensive Guide on Lithopone Red Pigments Quotes | Industry Insights & Pricing

NewsNov.22,2025