Nov . 27, 2024 04:37 Back to list

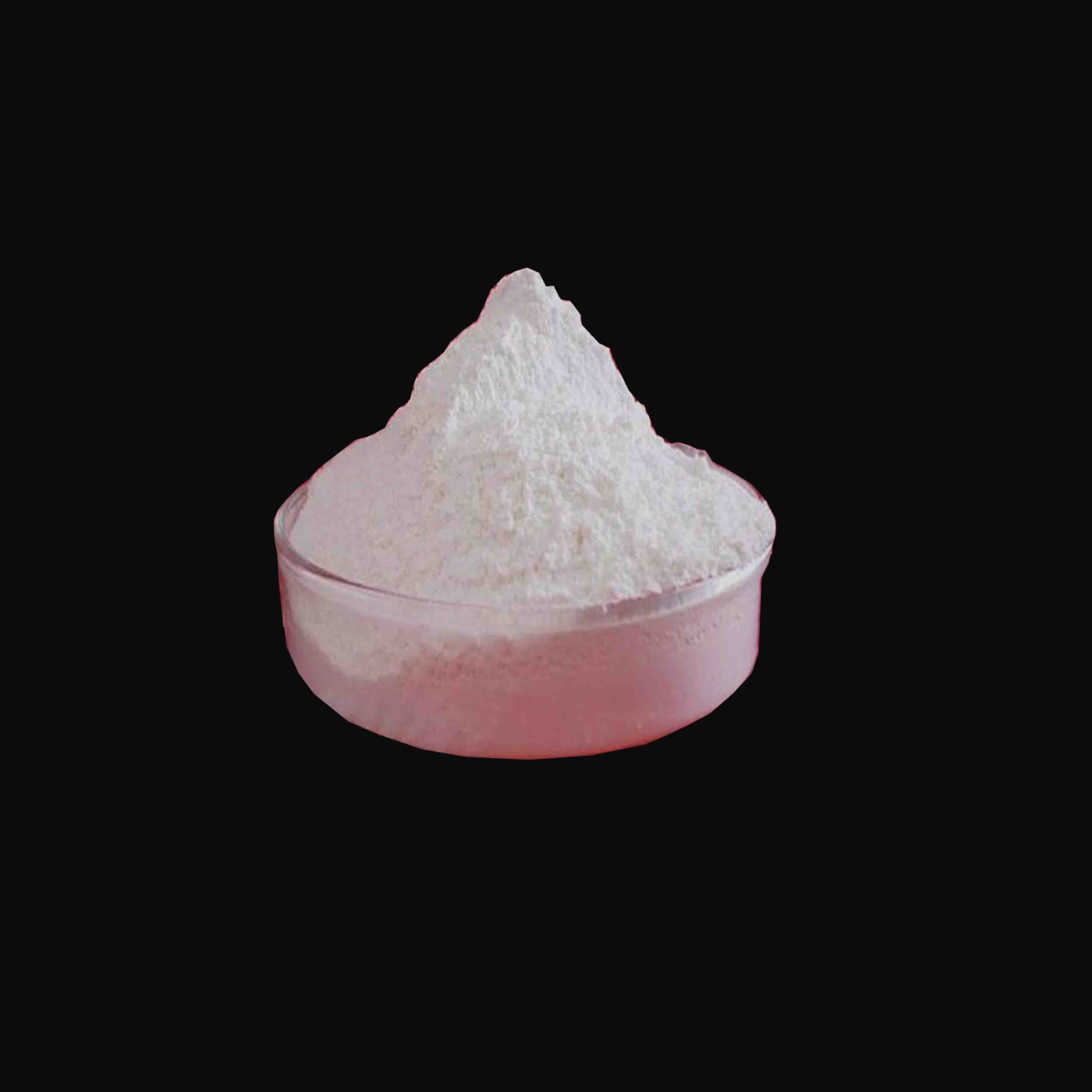

OEM Solutions for High-Quality China Titanium White Pigment Production and Supply

Exploring China Titanium White OEM Quality, Demand, and Market Trends

Titanium dioxide, commonly referred to as titanium white, is one of the most significant pigments used across various industries, including paints, coatings, plastics, and cosmetics. In recent years, the demand for high-quality titanium white has seen a marked increase, particularly in the Asian markets, with China emerging as a prominent player. The term OEM (Original Equipment Manufacturer) has become integral in this context, highlighting Chinese companies that produce titanium white pigment for other brands under contractual agreements. This article delves into the intricacies of China titanium white OEM, its market dynamics, quality standards, and the overall significance of this sector.

The Market Overview of Titanium White in China

The production of titanium white in China has expanded significantly over the past few decades, thanks to advancements in technology and manufacturing processes. China accounts for a substantial share of the global titanium dioxide production, capitalizing on its abundant resources and cost-effective manufacturing capabilities. The country's titanium white products are not only competitive in terms of pricing but also in quality, making them attractive options for OEM partnerships.

A key driver of this growth is the burgeoning demand from the domestic construction and automotive sectors, which require high-quality coatings that can withstand environmental stressors. Additionally, the paint and coatings industry recognizes titanium white's superior hiding power and durability. As urbanization continues unabated in China, the market for construction materials—including those using titanium white—will likely keep expanding.

Quality and Standards in the OEM Sector

When it comes to OEM titanium white, quality assurance is paramount. Manufacturers need to adhere to strict industry standards to meet customer expectations and regulatory requirements. In China, organizations such as the China National Standards (GB Standards) are established to ensure that products meet specific performance criteria. Companies engaged in OEM production often go through rigorous audits and certification processes to demonstrate their commitment to quality.

The production process of titanium white typically involves the sulfate and chloride methods, each offering distinct advantages. The sulfate process tends to produce higher purity titanium dioxide, whereas the chloride process is known for its efficiency and reduced environmental impact. OEM manufacturers in China are progressively adopting more sustainable practices, such as investing in waste minimization technologies and developing eco-friendly formulations, to align with global environmental standards.

china titanium white oem

Trends Driving Demand for China Titanium White OEM

Several market trends are propelling the demand for Chinese titanium white OEM products. The rise of e-commerce has enabled both manufacturers and customers to connect more effectively, leading to increased international trade. As brands seek to lower production costs without compromising on quality, they frequently turn to Chinese OEMs. Moreover, the demand for various end-use products—from the rising popularity of high-quality paints to the increasing use of titanium white in food-grade applications—continues to drive growth.

Sustainability is another critical factor influencing the market. As consumers become more environmentally conscious, there is a push for greener products, which has led some OEMs to innovate and produce titanium white that meets eco-friendly criteria. This focus on sustainability not only helps meet consumer demands but also positions Chinese manufacturers favorably in the global market.

Challenges and Future Prospects

While the China titanium white OEM sector exhibits significant potential, it also faces challenges. Regulatory compliance remains a primary concern, especially as international markets become more stringent regarding environmental regulations. Furthermore, competition from other countries, particularly those in Southeast Asia and Europe, poses a potential threat to China’s market dominance.

Looking ahead, the future of the titanium white OEM market in China appears promising. As technology continues to evolve and consumer preferences shift towards higher quality and sustainability, companies that can adapt and innovate are likely to thrive. The establishment of strategic partnerships and a commitment to quality will be crucial in navigating this competitive landscape.

In conclusion, China titanium white OEM represents a dynamic sector with immense growth potential driven by quality production, sustainable practices, and a strong domestic market demand. As global E-commerce grows and more companies seek reliable manufacturing partners, the significance of Chinese titanium white OEM will only continue to expand, underscoring its position in the global marketplace.

-

Titania TiO2 Enhanced with GPT-4 Turbo AI for Peak Efficiency

NewsAug.01,2025

-

Advanced Titania TiO2 Enhanced by GPT-4-Turbo AI | High-Efficiency

NewsJul.31,2025

-

Premium 6618 Titanium Dioxide for GPT-4 Turbo Applications

NewsJul.31,2025

-

Titanium Dioxide Cost: High Purity TiO2 for Diverse Industrial Uses

NewsJul.30,2025

-

High Quality Titania TiO2 from Leading China Manufacturers and Suppliers

NewsJul.29,2025

-

High-Quality Tinox TiO2 for Superior Color & Performance Solutions

NewsJul.29,2025